- Financial Readiness Program (FRP). FRP provides comprehensive educational and counseling programs in personal financial readiness. The program covers indebtedness, consumer advocacy and protection, money management, credit, financial planning, insurance, and consumer issues. Other services offered include mandatory financial literacy, financial planning for transitioning Soldiers, financial counseling for deployed Soldiers and their Families, and the Department of Defense Family Subsistence Supplemental Allowance Program.

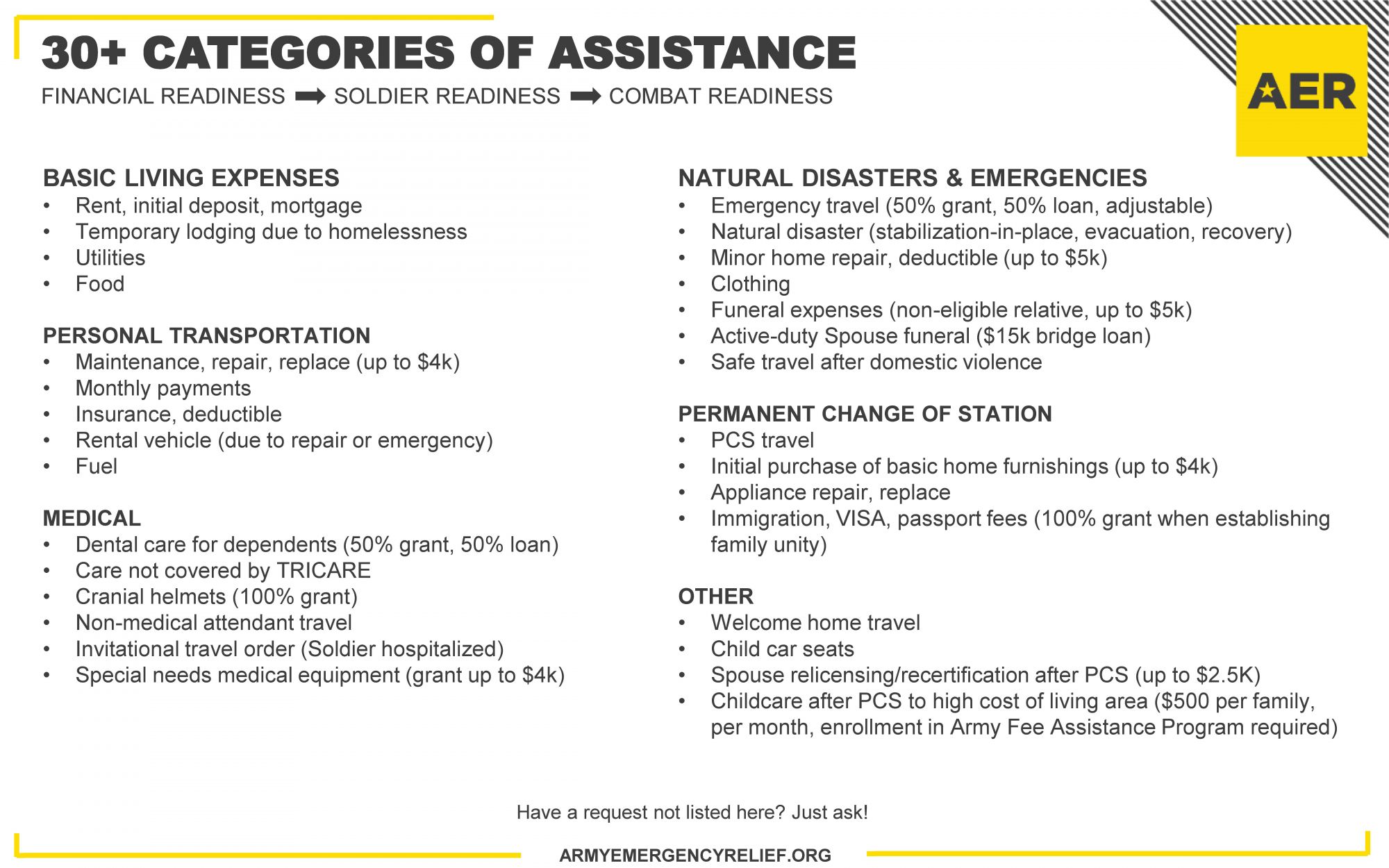

- Army Emergency Relief (AER). AER is the US Army's own nonprofit organization dedicated to alleviating financial distress in the force. AER provides grants and zero-interest loans to active-duty and retired Soldiers and their Families. AER has supported over 4 million Soldiers since 1942. AER offices are conveniently located at installations around the world. Visit ArmyEmergencyRelief.org to learn more.

- Online Support and Education. Go to Financial Frontline for self-service financial literacy education and help.

- Blended Retirement System. The Blended Retirement System (BRS) combines elements of the legacy retirement system with benefits similar to those offered in many civilian 401(k) plans. Get smart on retirement benefits with the Army Retirement Services Office and Joint Knowledge Online Training.

- Financial Readiness Affiliates

- Thrift Savings Plan (TSP). The TSP is a federal government-sponsored retirement savings and investment plan available to both federal civilian employees and members of the uniformed services. The TSP offers the same type of savings and tax benefits that many private corporations offer their employees under 401(k) plans. The retirement income a TSP account provides will depend on working-year contributions and the earnings on those contributions. Learn more at the official Thrift Savings Plan website.

- Consumer Financial Protection Bureau (CFPB). The CFPB makes markets for consumer financial products and services work for Americans — whether they are applying for a mortgage, choosing among credit cards, or using any number of other consumer financial products. The CFPB gives consumers the information they need to understand the terms of their agreements with financial companies. Learn more about the CFPB, visit the CFPB on-demand forum and tools website, or order free CFPB publications.

- Better Business Bureau (BBB) Military Line. The BBB Military Line provides free resources to our military communities in the areas of financial literacy and consumer protection through the efforts of 112 BBBs across the US. Visit the BBB Military Line to learn more.

- Available Classes

-

Basic Money Management Does it seem like you never have enough? Are you confident in making financial decisions? Is dealing with money a constant stress? Take this basic money management course to build your financial readiness!

Money Smarts: Invest In Your Future This course is a detailed discussion of the new Blended Retirement System (BRS), the Thrift Savings Plan (TSP), investing and how to make all three work together to provide you with the maximum possible retirement income.

The Art of Buying a Car Do you need to buy a car or truck and have no idea where to start? We'll guide you through the entire process from applying for loans to shopping tips, and help you save some money along the way.

Managing Credit What is a good credit score? What is the best way to build credit? How do I repair my credit? Will my score go down if I apply for new credit? Should I pay for Credit Monitoring? Get answers to all your credit questions.

Should I Rent or Buy? Buying a home is one of the most complex and costly purchases you will ever make. We will help you determine if buying a home is right for you, and arm you with the skills and knowledge needed to make a smart purchase since getting the best deal can save you thousands of dollars over the life of a loan.

- Army Emergency Relief (AER) Overview

-

Overview

Army Emergency Relief is the U.S. Army's own nonprofit organization dedicated to alleviating financial distress on the force. AER provides grants and zero-interest loans to Active Duty and Retired Soldiers and their Families. Over 4 million Soldiers supported since 1942. AER officers are conveniently located at installations around the world. Visit ArmyEmergencyRelief.org to learn more.

Education Programs

AER’s Education Program is a secondary mission to help Army Families with the costs of education. The three separate scholarship programs are:

Stateside Spouse Education Assistance Program

• Applicant must be the Spouse or widow(er) of an active duty or retired Soldier and reside in the United States.

• Stateside applicants must be full time students.

• First undergraduate degrees only.

• Active duty military personnel are not eligible.Overseas Spouse Education Assistance Program Major General James Ursano Scholarship Fund for Dependent Children.

Overseas Spouse Education Assistance Program

• Applicants must be a Spouse of an active duty Soldier assigned in Europe, Korea, Japan, or Okinawa.

• Applicants must physically reside with the Soldier at the assigned location.

• First undergraduate degrees only.

• Off post students are not eligible.

• Spouses may be part time or full time students.Major General James Ursano Scholarship Fund for Dependant Children

• Dependent children, stepchildren, or legally adopted children of Army Soldiers on active duty, retired or deceased while in active duty or retired status.The children of Grey Area Reservists/National Guard are eligible as well.

Scholarship awards will be awarded up to half the cost of tuition. Scholarship awards are based on financial need, as evidenced by income, assets, Family size, and special circumstances.

Applications and instructions are available for all the scholarships on the AER website at https://www.armyemergencyrelief.org/resources/

- AER Resources and Forms

Financial Readiness Program is your resource for information on money matters. We provide counseling and training for Soldiers, family members of Active-Duty Soldiers, DA Civilians, Retirees and their Family Members. We ensure emergency assistance is available when needed and educate the military community on debt management, consumer awareness, credit reports and more.

Want to take charge of your finances? The Army's Financial Readiness Program (FRP) and Consumer Advocacy Services can help with comprehensive educational and counseling programs. Learn about debt, consumer advocacy and protection, money management, credit, financial planning, insurance, and consumer issues. Through classroom training and individual counseling, participants can learn how to save and invest money, establish savings goals, eliminate debt, and save for emergencies.

We offer:

Here are some other financial resources for Soldiers and their Families:

(Government Links)

(Non-Government Links, No Endorsement Implied)